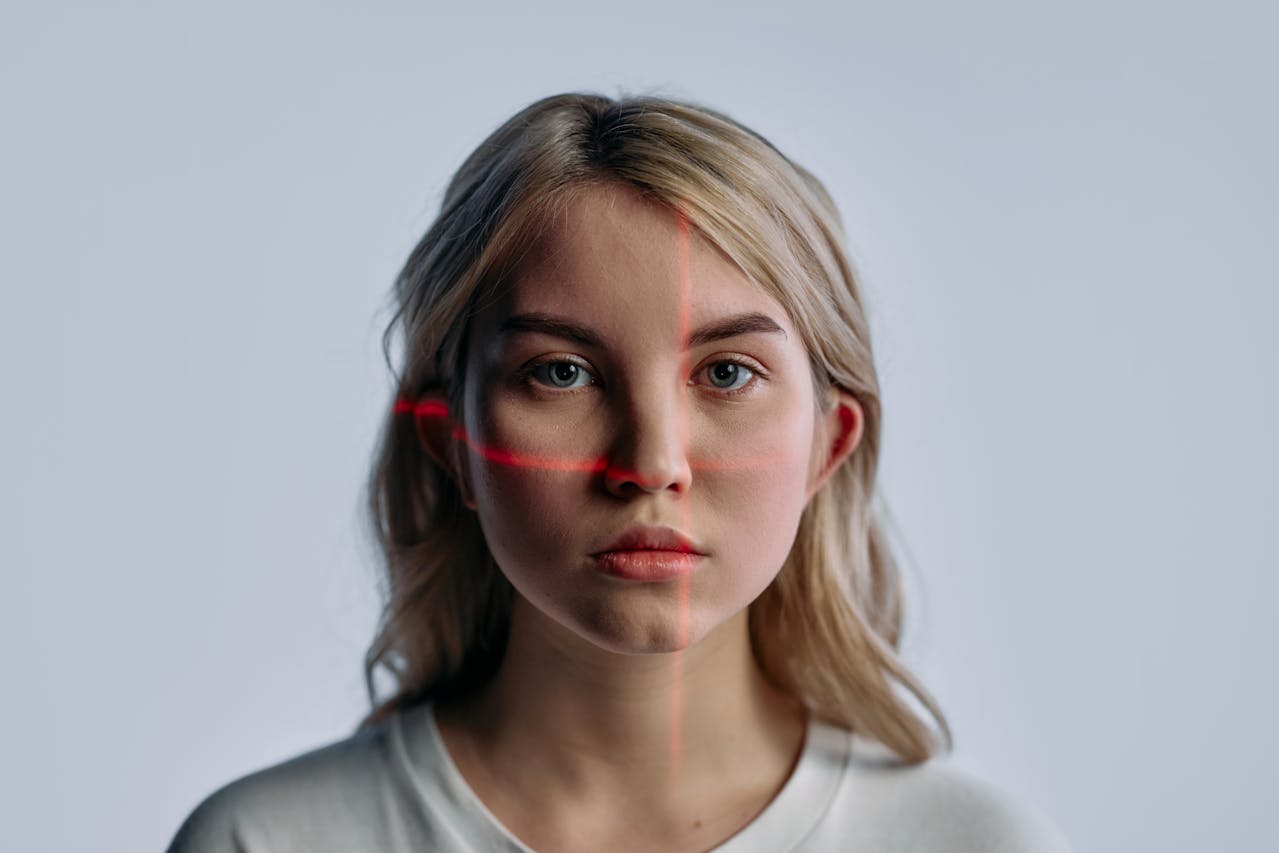

From unlocking your phone with a glance to passing through airport security without handing over a passport, biometric verification has moved from science fiction to everyday convenience. But beyond convenience lies its true promise: reshaping the future of digital identity. In a world where fraud is increasingly sophisticated and regulations ever tighter, biometrics offer a path toward greater trust, compliance, and user experience.

At Aristotle Integrity, we believe biometric data is one of the most powerful tools in the identity verification arsenal—when it’s used responsibly, securely, and in combination with other trusted data sources.

What Is Biometric Verification?

Biometric verification uses a person’s unique physical or behavioral characteristics to verify identity. The most common biometric identifiers include:

- Facial recognition

- Fingerprint scanning

- Iris or retinal scans

- Voice recognition

- Behavioral patterns (e.g., typing rhythm or mouse movement)

These traits are nearly impossible to replicate or steal in a traditional sense, making them a strong defense against identity theft and impersonation. With the increased use of AI, fraudsters are getting more sophisticated at finding the gaps in defenses.

Why Is Biometric Verification Gaining Traction?

1. Passwords and PINs Are No Longer Enough

We’ve all seen it: users reusing the same weak password, forgetting their credentials, or falling victim to phishing attacks. Knowledge-based authentication has always relied on information that can be guessed, shared, or stolen. Biometrics, on the other hand, are inherently bound to the individual. You are your password.

2. Fraud Tactics Are Getting Smarter

Fraudsters no longer need to steal your wallet—they just need a few pieces of your PII (personally identifiable information) to create synthetic identities or take over accounts. Biometric verification makes it significantly harder to complete fraudulent transactions, especially when layered with document and behavioral analysis.

3. Regulators Are Raising the Bar

From KYC (Know Your Customer) to AML (Anti-Money Laundering) laws, regulators are demanding more stringent verification—particularly in high-risk sectors like finance, crypto, and iGaming. Biometrics help companies comply with these evolving standards without adding friction to the user experience.

The Integrity Approach: Biometrics as Part of a Bigger Picture

While biometric verification is powerful, it shouldn’t operate in a vacuum. Aristotle Integrity takes an orchestration-based approach to identity verification, meaning we blend biometric signals with multiple trusted data layers:

- Government-issued IDs (e.g., driver’s license, passport)

- Document authentication

- Credit, utility, and residence data

- Voter registration

- Device and IP intelligence

- Real-time fraud indicators

By combining Integrity AutoDoc (our document and biometric analysis solution) with Integrity IdentityRep (our real-time fraud signal engine), we offer layered security without compromising speed or accuracy.

Use Cases: Where Biometrics Are Making an Impact

Age-Gated Services

Whether it’s alcohol, tobacco, or gaming, age verification is crucial—and often targeted by fraud. With biometric facial matching and liveness detection, users can prove identity and age in seconds without mailing in documents or completing tedious forms.

iGaming & Sports Betting

Operators need to onboard users quickly while staying compliant with KYC and responsible gambling regulations. Biometrics offer a seamless way to verify identity and catch fraud before it happens—while creating a more user-friendly sign-up flow. In certain instances, biometrics can authenticate players instantaneously before they make withdrawals or deposits, providing an additional layer of security.

Fintech and Digital Wallets

Account takeover is a top concern in digital banking. Biometric re-verification during high-risk actions—like adding a new device or changing a payment method—adds a powerful layer of trust.

Mobility and Car Rentals

Companies need to verify a person’s identity and driver’s license before releasing a vehicle. With a combination of document capture and facial biometrics, customers can complete verification from their phones—no lines, no paperwork.

Challenges and Considerations

While biometrics offer significant advantages, they’re not without concerns:

- Privacy and data protection: Biometric data is sensitive and immutable. If it’s compromised, it can’t be changed like a password. Integrity prioritizes secure encryption, compliance with KYC and AML, and minimal data retention.

- Liveness detection: Simply matching a photo isn’t enough. Systems must detect whether the image is live and not a spoof (e.g., a photo or deepfake). Our biometric solution includes robust anti-spoofing technology.

- Accessibility and inclusivity: Not all users are comfortable with or capable of biometric capture. That’s why our orchestration approach allows fallback options using trusted data sources.

Looking Ahead

As digital services expand, identity verification must keep up—not only with fraud, but with user expectations. Biometric verification offers speed, security, and confidence. When integrated into a multi-layered orchestration platform like Aristotle Integrity, it’s not just a futuristic add-on—it’s a cornerstone of modern trust.

How can Integrity help enhance your biometric verification process? Click the “FREE DEMO” button in the upper right corner and a representative will suggest the proper solution to meet your needs.